※Documents only in Mandarin.

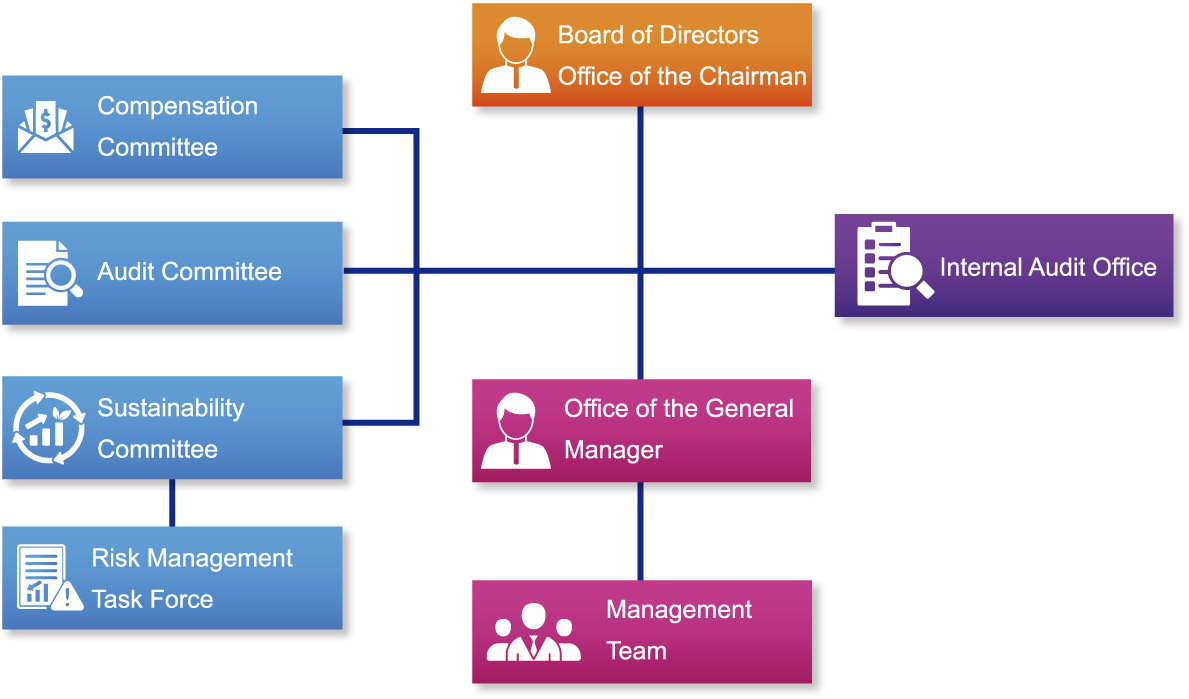

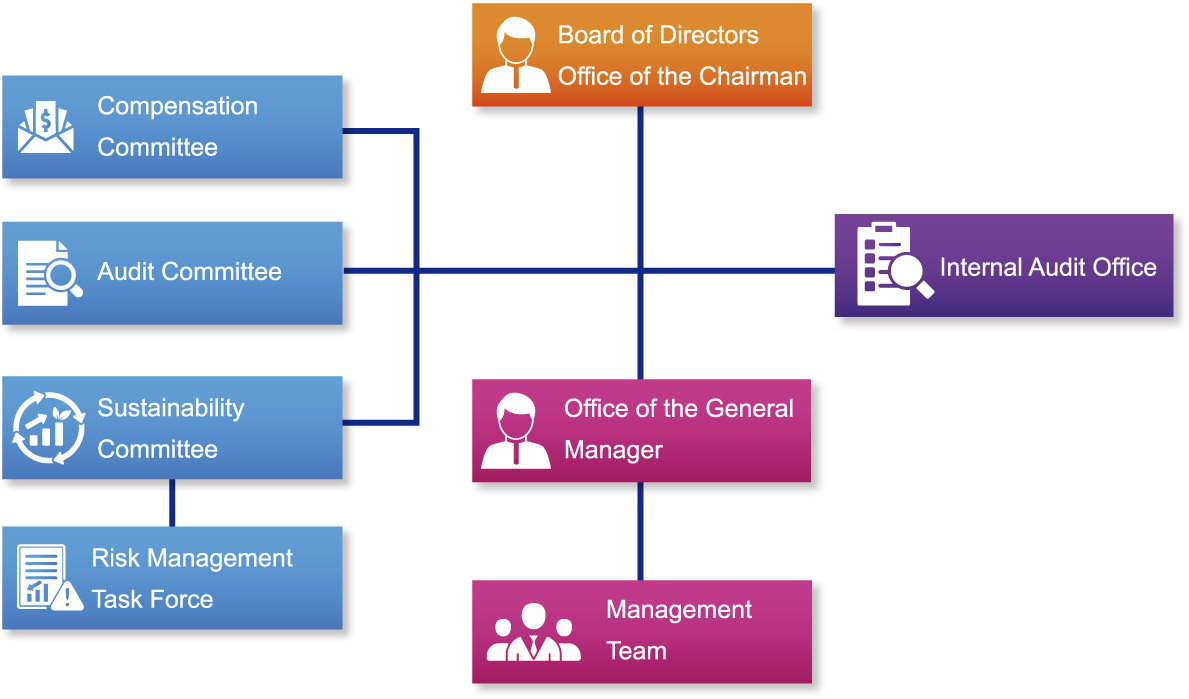

The company has established an internal audit function to assist the Board of Directors and management in identifying and addressing deficiencies within the internal control system. The objectives include evaluating the effectiveness and efficiency of operations, ensuring the reliability of financial statements, and verifying compliance with relevant laws and regulations.

The internal audit function also provides timely recommendations for improvements, ensuring the continuous and effective implementation of the internal control system. This process serves as a foundation for refining the system and promoting the company’s sound and sustainable operations.